Morning Commentary

Morning Commentary

By Charles Payne, CEO & Principal Analyst

12/26/2014 7:59 AM

Watch my show: Making Money With Charles Payne Fox Business 6PM

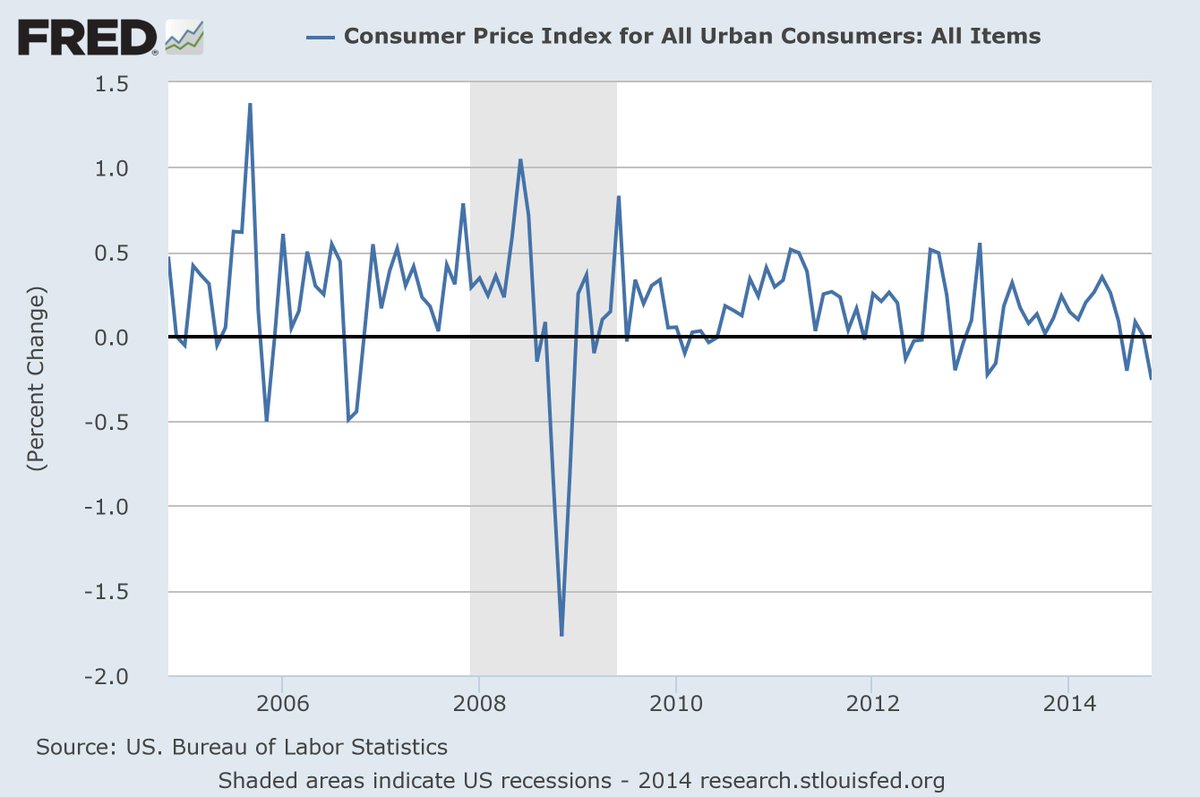

Could we be entering into a golden period where inflation is not only not an issue, but prices are falling in so many key areas of day to day life that it amplifies income even though wages aren't rising?

The short answer is “yes,” and it's what the Fed has been working toward for years. The other question is “has this reward been worth the risk?”

That answer remains to be seen. Critics, including myself, frown upon the way money printing makes the dollar weak and eventually leads to major inflation. But, today the dollar is strong and prices are in free fall. It's not just crude, but things like apparel and used cars. Only electricity, which the White House warned would necessarily move higher as a consequence of killing the coal industry, is still edging higher. And while plenty of homemakers will point to things like higher beef prices, it's hard to deny cheap gas and other things aren't having an impact.

Last month, consumers spent money faster than they earned it and dipped into savings to make it happen. Blind confidence? Certainly it’s disturbing, but it's what the architects of money printing have been seeking.

I'm only going to remind everyone there is a threat of deflation even as the dynamics of oil and gasoline used has changed from the past. We aren't going to base any investments on it because I'm not sure it's different this time, but right now it looks different.

Right now, we're basing investment strategy on this window in time a burgeoning golden period that needs one key ingredient of higher wages to move into the next level. Maybe we dodge deflation and later in 2015, the worry is too much money is chasing too few goods. In such a scenario, it feels real good and lots of money can be made in the market. For those that think Fed policy got the market to this level- wait until it goes into overdrive and the S&P is trading at a PE of 23 or more.

So, we ride the wave for now and into 2015.

Today’s Session

Stable World

"To a surrounded enemy, you must leave a way of escape"

Sun Tzu

Going into the New Year, I remain concerned about the wounded bear. Russia, or more importantly, Vladimir Putin, took a serious hit this year, but the net effect has been people rallying around their strongman and emboldened him to take more chances that could truly destabilize the world.

On January 1, 2014, Russia had the 8th largest economy in the world.

On December 26, 2014, Russia has the 15th largest economy in the world.

Over the last couple of weeks, the Ruble has improved dramatically against the US dollar although it’s still a fractured currency that can't be shored up with $56 crude oil.

Then there's North Korea which is struggling again today with internet issues. That nation has become a perennial time bomb in the news over a movie. For the record, I do not think North Korea hacked Sony, but I do think their dictator is a loose cannon, but he could actually be a bigger problem for China than America as they try to control this petulant child. I'm not going to see the movie, although I’m glad Sony grew a backbone and I don't think Seth Rogan is our Salman Rushdie- but we could be onto something here with movie release models for the future.

Here At Home

People are feeling better. There is in fact the kind of momentum that could begin to have a self-fulfilling effect on behavior and the economy. It will be critical; that momentum shows up in January to set the mood. The latest poll to reflect this budding optimism comes from CNN.

We aren't chasing the open this morning. There are numerous positions on the model portfolio that are still within buying range- for help contact your rep or the research@wstreet.com.

Stay in the holiday spirit.

| Comments |

| I believe strongly that we should not look at how low the price of oil will be. My question is who can follow the Saudis policy of low prices. Those not able to feed their budgets with crude oil dollars have two possibilities: 1. going bankrupt, the like of Venezuela comes to mind. 2. Devalue their currency, Nigeria has. Those outside OPEC have the same problems, Russia comes to mind. In the US we will see few M&A, which will be healthy. The majors will not be hurt; few are reorganizing their asset with a bigger US foot print. This will lower the exchange rate risks. I believe the US will allow oil export, if not near term, after 2016 for sure. This will be a bonanza for US producers. This is the time to pick and choose who you want to buy. My belief is that buying overseas assets will be buying substantial strong devaluations risks, which includes high taxes. The dollar will get stronger; the FED will withdraw dollars out of circulation and will increase interest rates. We saw this movie in the 70s under Carter! To see the dollar versus crude price differential, look at the price of gold. When Nixon decoupled the dollar from the gold, the Saudis have kept the value of a barrel of crude study versus One ounce of gold. The barrel of crude has averaged 15 barrels of crude oil to one ounce of gold. Last time it was 15 was last November, today gold is 20 times crude oil. The Saudis are losing quite a bit! ousaou on 12/26/2014 12:01:39 PM |

| Tweet |

Log In To Add Your Comment

| 5/3/2024 1:41 PM | Cheering the News |

| 5/3/2024 7:33 AM | TIM COOKS THE (RECORD) BOOKS |

| 5/2/2024 1:54 PM | Holding Up |

| 5/2/2024 9:41 AM | COOL HAND POWELL |

| 5/1/2024 1:22 PM | Which Powell? |

| 5/1/2024 9:40 AM | MAY DAY, MAY DAY, MAY DAY † |

| 4/30/2024 1:02 PM | Complete Flop |

| 4/30/2024 9:48 AM | CHIPS TAKE THE LEAD † |

| 4/29/2024 1:39 PM | Musk Rides Back to the Mag Seven |

| 4/29/2024 9:50 AM | DIE BY THE SWORD, PROSPER BY THE SWORD |

| 4/26/2024 1:46 PM | Full Steam |

| 4/26/2024 9:39 AM | BIG TECH STEPS UP |

| 4/25/2024 1:16 PM | Don't' Bury me, Yet! |

| 4/25/2024 9:27 AM | THERE CAN ONLY BE ONE |

| 4/24/2024 1:30 PM | Earnings Flood In |

| 4/24/2024 9:26 AM | BUYING THE DIP |

| 4/23/2024 1:25 PM | Bloom Off Rose |

| 4/23/2024 9:32 AM | WHAT HAPPENED TO THE BRAVADO? † |

| 4/22/2024 1:22 PM | Pins and Needles |

| 4/22/2024 9:30 AM | LIVE BY THE SWORD Ö |

| 4/19/2024 1:20 PM | Fair Chunk of Rotation |

| 4/19/2024 9:35 AM | DONíT OVERREACT † |

| 4/18/2024 1:37 PM | Didnít Break Down |

| 4/18/2024 9:40 AM | MARKET OFF SCRIPT † |

| 4/17/2024 1:59 PM | Facing Pressure |

| More commentary archives | |

|

Home |

Products & Services |

Education |

In The Media |

Help |

About Us |

Disclaimer | Privacy Policy | Terms of Use | All Rights Reserved.

|