Morning Commentary

Morning Commentary

By Charles Payne, CEO & Principal Analyst

2/27/2015 7:01 AM

The market has begun to spin its wheels and that makes people nervous. I will lay out the red flags. I am not talking about the $18 trillion in government debt, the Fed's balance sheet, or the ticking time bomb of pensions, but trends that could arguably derail the stock market rally.

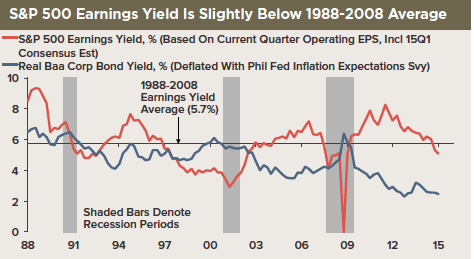

Earnings are beating lowered estimates, but are yielding less than the twenty-year average. Sure, stock yields are attractive versus bond yields, but are they good enough to justify higher share prices? Here is the rub: consensus on earnings points lower and lower for this year, but it should reverse and move higher as we enter 2016. So, should stocks pullback before then and reaccelerate?

I am not sure. Overall, I do not like earnings in retreat, even if a large part can be explained by the strong dollar limiting the top line and pressuring margins. We focus on individual names, yet this is something we will monitor closely.

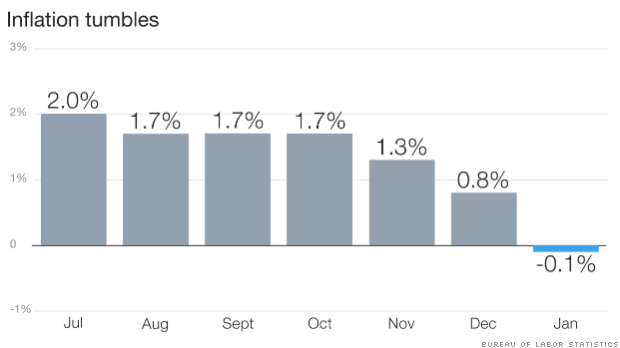

However, there is the deflation question that will not go away. The consumer price index (CPI) inflation reading was negative for January, down three months in a row; it experienced its largest one-month decline since Dec 2008, and has gone down year-over-year. The good news for those worried about the Fed hiking rates is that this puts them off again. The bad news is deflation is insidious.

Then, there is the average daily volume that continues to plummet. The only spikes are associated with periods of duress.

In the end, the market moves higher when there are more buyers than sellers, even if the overall volume is light. It is not a red flag, but it is worth monitoring. The flip side is those trillions of dollars on the sidelines; bond market and overseas could still find their way into U.S. equities, making this a moot point.

In the meantime, insider sells are picking...in the last 12 months:

- $6.55 billion in sells

- $177 million buys

We will watch. The worst-case scenario at the moment is a sudden panic from one of the above. We are not too expensive to warrant the selloff from the naysayer crowd. We are overdue for a pullback, but that’s it at the moment.

Today’s Session

The Bureau of Economic Analysis (BEA) downwardly revised its original Q4-2014 US gross domestic product (GDP) growth estimate to 2.2% from an earlier estimate of 2.6%. The equity markets were unmoved by this and proceeded to open in the red as this reading is far lower than the impressive 5.0% growth observed in Q3-2014. Nonresidential fixed investment increased more than originally estimated while private inventory investment increased less than measured last month. One highlight from the report is that consumer contributions were still strong as personal consumption expenditures rose 4.2% in the quarter, significantly higher than the 3.2% increase observed in the previous quarter.

| Comments |

| A recent bumper sticker says, "If you don't go 1st class your heirs will". Many of us with under-employed adult children are going "coach" just so they may have some level of retirement later on. John Kaye on 2/27/2015 11:00:43 AM |

| We are DUE FOR A BIG CORRECTION, I am retired so I am in bonds and some prefereds, so I am fairly safe. Joe caymin on 2/28/2015 1:47:53 AM |

| Tweet |

Log In To Add Your Comment

| 4/25/2024 1:16 PM | Don't' Bury me, Yet! |

| 4/25/2024 9:27 AM | THERE CAN ONLY BE ONE |

| 4/24/2024 1:30 PM | Earnings Flood In |

| 4/24/2024 9:26 AM | BUYING THE DIP |

| 4/23/2024 1:25 PM | Bloom Off Rose |

| 4/23/2024 9:32 AM | WHAT HAPPENED TO THE BRAVADO? † |

| 4/22/2024 1:22 PM | Pins and Needles |

| 4/22/2024 9:30 AM | LIVE BY THE SWORD Ö |

| 4/19/2024 1:20 PM | Fair Chunk of Rotation |

| 4/19/2024 9:35 AM | DONíT OVERREACT † |

| 4/18/2024 1:37 PM | Didnít Break Down |

| 4/18/2024 9:40 AM | MARKET OFF SCRIPT † |

| 4/17/2024 1:59 PM | Facing Pressure |

| 4/17/2024 9:37 AM | POWELL STILL WANTS TO HELP † |

| 4/16/2024 1:35 PM | Muted |

| 4/16/2024 9:42 AM | FEAR ARRIVES † |

| 4/15/2024 1:17 PM | Making a Statement |

| 4/15/2024 9:45 AM | Equal Opportunity Drubbing |

| 4/12/2024 1:37 PM | Pressure Overall |

| 4/12/2024 9:42 AM | WHO YA GONNA CALL? |

| 4/11/2024 1:38 PM | No Urgency |

| 4/11/2024 9:27 AM | Tough Sledding |

| 4/10/2024 1:22 PM | Hang In There |

| 4/10/2024 9:51 AM | HERE COMES THE LATEST RATIONALE FOR PERSISTENT INFLATION |

| 4/9/2024 1:56 PM | Fighting the Trend |

| More commentary archives | |

|

Home |

Products & Services |

Education |

In The Media |

Help |

About Us |

Disclaimer | Privacy Policy | Terms of Use | All Rights Reserved.

|