Morning Commentary

Morning Commentary

By Charles Payne, CEO & Principal Analyst

10/24/2014 8:11 AM

I spoke to the neighbor of the NYC Ebola doctor (turned patient) a couple of times, last night. Her fears are less about contracting the disease than having her family's names and photos splashed over the media, particularly those of her 16 year old daughter who is very talented, outgoing, and attends a high profile high school. The media has been unrelenting, but for the most part all promised not to mention her or her daughter’s names.

One network is struggling, and say even without permission, they'll display a blurred photo of her daughter with her name. In this day and age, it could lead to near-term disaster.

There have been questionable actions on the part of authorities that have not gained the confidence of people in the building.

On that note, I grew up two blocks from the building the Ebola patient lives in, and I've been in that building a lot, although not this year. Like most New Yorkers, the people there are used to toughing it out, especially those there before gentrification began over the past decade. In many ways, this is the moment of truth to speak that had to happen: Ebola comes to the big city. We've seen the movie, or television show script for years; it’s supposed to spread like wildfire.

The thing is the disease didn't spread like wildfire in Dallas, but this is a larger stage and the perfect moment of truth. I will say, if there is no spread of the disease, it will not be because the authorities did everything right – protocols still need to evolve just from mistakes made in the first few hours of the New York patient. New Yorkers are tough but not dumb, and when obvious mistakes are made, they get upset, not afraid.

So, I can say the neighbor that shares the same common wall with the NYC Ebola patient is more afraid about her daughter potentially being mistreated at school than about contracting the disease. In the meantime, this patient was totally inconsiderate, which is shocking since helping people is the hallmark of Doctors Without Borders.

On one hand, willing to risk their his own life to help people in impoverished nations is admirable, but to then come to NYC knowing he was high-risk and still meandering around town, riding the subway, going bowling and hanging out in general, is irresponsible and unethical.

Markets & Emotions

On a normal day, in America, people are mostly worried about paying rent, putting children through college or wondering if they'll ever get to stop working. So why is it that with the stock market, which is supposed to mirror society, things we aren't normally worried about day-to-day, can wreck or psyches and our fortunes?

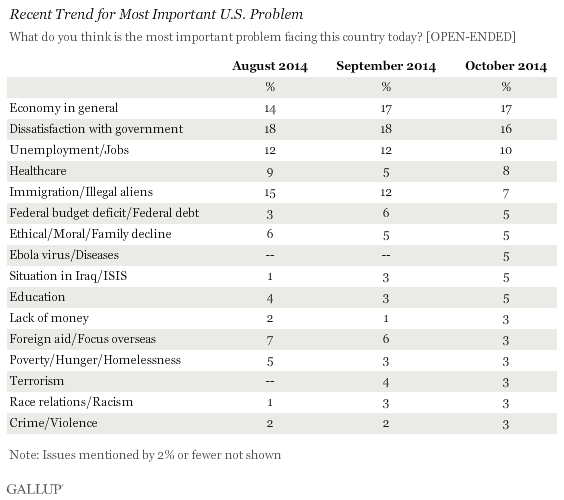

Consider this week, Ebola finally cracked the list of "most important problems facing the country” yesterday with 5% of the vote.

For weeks, when ISIS was on the march, it captured the attention of the market sending it down quickly, but only 1% worried about these savages in August, 3% last month, and only 5% give it top ranking now. And Wednesday, what appeared to be an act of terror rattled the market, but when the opening bell rang terror, only 3% of Americans felt it was the most important problem facing the country."

I've watched equity futures since the Ebola news broke in NYC and they've gotten better, but are still in the red. The financial media, which I called out last Thursday, is walking a tighter rope – the fear guys that hate the rally are chomping at the bit to derail this thing once and for all, but know the microscope is greater now, and their fiduciary responsibility as journalists and "experts" that can move markets will be scrutinized.

Of course, this is a huge story and if the disease caused Americans to stay home, it would be a giant financial story. There are a lot of things people ask themselves that seem like common sense questions, however I'm not sure it’s unusual for an Ebola patient to have their body temperature go to 103 from 99 overnight. This isn't the common cold or flu.

We have to play this day by day, though like a bull market that runs into trouble, it's the only way to be sure that this is the moment of truth on the biggest stage in America. If it doesn't spread, then the disease is hard to contract and people that live in the Bronx, Queens, Staten Island, Pennsylvania and other parts of the nation don't need to stay home out of fear. It will be touch-and-go for a few days as we have a fresh 21-day clock, so there will be headline risks.

The key for the market (and those that help investors in the market) is to let the headlines be actual news rather than another reason to hate the rally or gain television ratings.

For now, pray not only for the safety of those that live near the doctor or might have come in contact with him in a dangerous way, but for their health and hope they can escape without the disease or some kind of label that actually hurts their lives more, even if the disease is contained.

Today’s Session

The major indices are poised to open lower this morning. Globally, markets were under pressure overnight. In Europe, there are concerns that a majority of the banks that underwent stress tests failed. In China, increased property prices in 10 out of 70 cities (a month ago 48 cities saw prices rise). The smaller amount of cities exhibiting price increases may mean that there are less consumers investing in purchasing properties presumably due to low economic outlooks. Domestically, our futures are down due to concerns over the spread of Ebola here in NYC. However, Corporate America is painting a very nice picture of Q3-2014 and where our economy is headed. Below is a chart displaying the earnings results of many key companies that reported yesterday after the close and this morning.

|

Company |

Ticker |

EPS (Actual) |

EPS (Est) |

Rev (Actual $M) |

Rev (Est $M) |

|

Amazon.com |

AMZN |

-0.95 |

-0.76 |

$20,580.00 |

$20,846.47 |

|

Chubb |

CB |

2.17 |

1.95 |

$3,169.00 |

$3,115.59 |

|

Deckers Outdoor |

DECK |

1.17 |

1.03 |

$430.30 |

$457.22 |

|

Edward Lifesciences |

EW |

0.80 |

0.72 |

$607.40 |

$546.10 |

|

Hub Group |

HUBG |

0.49 |

0.54 |

$913.38 |

$918.32 |

|

Microsoft** |

MSFT |

0.54 |

0.48 |

$23,200.00 |

$21,995.30 |

|

Pandora Media |

P |

0.09 |

0.08 |

$239.60 |

$238.58 |

|

Swift Transportation |

SWFT |

0.39 |

0.35 |

$1,070.00 |

$1,099.78 |

|

Bristol-Myers |

BMY |

0.45 |

0.42 |

$3,921.00 |

$3,817.59 |

|

Colgate-Palmolive |

CL |

0.76 |

0.75 |

$4,379.00 |

$4,439.37 |

|

Ford Motors |

F |

0.21 |

0.19 |

$32,800.00 |

$33,209.79 |

|

Lear* |

LEA |

1.93 |

1.88 |

$4,232.70 |

$4,269.17 |

|

Lifepoint Hospitals* |

LPNT |

0.75 |

0.73 |

$1,166.00 |

$1,085.54 |

|

Moody's |

MCO |

0.97 |

0.90 |

$816.10 |

$787.18 |

|

New Oriental Education |

EDU |

0.73 |

0.88 |

$394.00 |

$417.15 |

|

Procter & Gamble** |

PG |

1.07 |

1.08 |

$20,792.00 |

$20,786.92 |

|

State Street |

STT |

1.26 |

1.21 |

$2,678.00 |

$2,637.67 |

|

United Parcel Service* |

UPS |

1.32 |

1.28 |

$14,290.00 |

$14,199.17 |

|

Wyndham Worldwide |

WYN |

1.67 |

1.63 |

$1,514.00 |

$1,529.17 |

* = Open WSS Idea ** = Dow Component

| Tweet |

Log In To Add Your Comment

| 4/19/2024 1:20 PM | Fair Chunk of Rotation |

| 4/19/2024 9:35 AM | DONíT OVERREACT † |

| 4/18/2024 1:37 PM | Didnít Break Down |

| 4/18/2024 9:40 AM | MARKET OFF SCRIPT † |

| 4/17/2024 1:59 PM | Facing Pressure |

| 4/17/2024 9:37 AM | POWELL STILL WANTS TO HELP † |

| 4/16/2024 1:35 PM | Muted |

| 4/16/2024 9:42 AM | FEAR ARRIVES † |

| 4/15/2024 1:17 PM | Making a Statement |

| 4/15/2024 9:45 AM | Equal Opportunity Drubbing |

| 4/12/2024 1:37 PM | Pressure Overall |

| 4/12/2024 9:42 AM | WHO YA GONNA CALL? |

| 4/11/2024 1:38 PM | No Urgency |

| 4/11/2024 9:27 AM | Tough Sledding |

| 4/10/2024 1:22 PM | Hang In There |

| 4/10/2024 9:51 AM | HERE COMES THE LATEST RATIONALE FOR PERSISTENT INFLATION |

| 4/9/2024 1:56 PM | Fighting the Trend |

| 4/9/2024 9:46 AM | NEXT TIME, MAKE IT A HOLIDAY |

| 4/8/2024 9:45 PM | Cautious Feel |

| 4/8/2024 7:19 AM | ITíS ECLIPSE DAY |

| 4/5/2024 1:51 PM | Higher and Cheaper |

| 4/5/2024 9:23 AM | MARKETS REEL ON BIDENíS ISRAEL ULTIMATUM |

| 4/4/2024 1:42 PM | Stocks Bounce |

| 4/4/2024 9:31 AM | ESCAPING GRAVITY = ESCAPING REALITY? |

| 4/3/2024 1:41 PM | Cuts Not Soon |

| More commentary archives | |

|

Home |

Products & Services |

Education |

In The Media |

Help |

About Us |

Disclaimer | Privacy Policy | Terms of Use | All Rights Reserved.

|