Morning Commentary

Morning Commentary

By Charles Payne, CEO & Principal Analyst

10/21/2014 9:55 AM

The midterms are two weeks from now, and either it's going to be the most boring midterm election in history, or the mainstream media isn't going to be happy about the polls, but investors might be, and of course, with so much despair out there, everyone is interested in where we go from here.

Take a look at the messages both parties are spending money on for Senate seats:

Matching Messages with Concerns and (Really) Winning

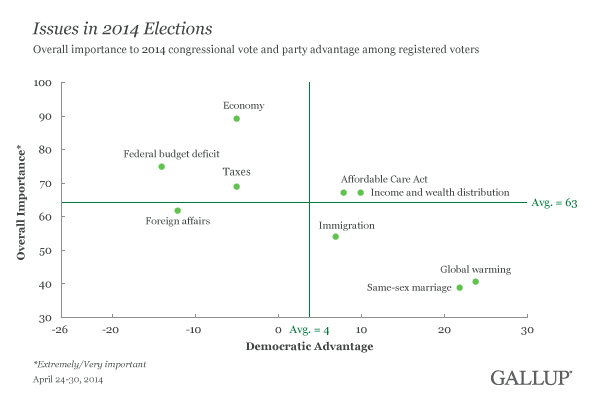

Republicans seem to be on the right track, except for maybe spending too much time and money on Obama-care. Take a look at the table below and see what I'm talking about... the GOP polls higher on the top three issues this year.... economy, federal deficit, and taxes. The Affordable Care Act ranks third and the Dems are actually polling better there. Of course, the Dems have spent a ton of money on social issues that are barely on the radar.

The bottom line is winning in November because the electorate is fed up with Democrats. President Obama isn't an overwhelming vote for GOP policies, which have to be proven to be better for America, but first must be concise and unified. Winning in two weeks and losing in two years is winning a battle, but losing the war. The economy should get a natural boost in the form of a sigh of relief in a couple of weeks if polls prove to be correct. The economy would get a bigger long-term win if the GOP stays on top of the topics most important to Americans right now.

Hint: It's not gay marriage or bragging about not pandering.

If Democrats retain control of the Senate, it would be a major blow, although it would underscore the point I'm trying to make. It would be unnerving that people would vote on issues they aren't truly concerned about like global warming simply because there was no cohesive counter-argument.

Earnings Message

It's been an uneven round of earnings since the closing bell yesterday. Apple simply blew away the Street and if it were any other company, the stock would be up 20%, but instead, it’s up a couple of dollars, but it should still open at a new all-time high.

Interestingly, the biggest losers are big time Dow components which are weighing on the index which was poised to be up 100 points. It might speak to the need to freshen up the index. Sure, many of these components haven't been in the index as long as it seems, but they're older companies that have to reinvent themselves again. Of course things haven't changed so much in insurance and aircraft that United Technologies and Travelers are in the same predicament as McDonald's, Coke and IBM.

|

Company |

Year Founded |

Year on DJIA |

|

MCD |

1940 |

1985 |

|

KO |

1886 |

1987 |

|

IBM |

1911 |

1979 |

|

UTX |

1934 |

1939 |

|

TRV |

1853 |

2009 |

|

Company |

Ticker |

EPS (Actual) |

EPS (Est) |

Rev (Actual $M) |

Rev (Est $M) |

|

|

Apple* |

AAPL |

1.42 |

1.31 |

$42,123.00 |

$39,839.13 |

|

|

Chipotle Mexican Grill |

CMG |

4.15 |

3.84 |

$1,084.10 |

$1,059.77 |

|

|

Rent-A-Center |

RCII |

0.49 |

0.47 |

$769.50 |

$772.95 |

|

|

Steel Dynamics |

STLD |

0.47 |

0.44 |

$2,339.02 |

$2,143.61 |

|

|

Texas Instruments |

TXN |

0.76 |

0.71 |

$3,501.00 |

$3,452.72 |

|

|

Werner Enterprises |

WERN |

0.36 |

0.36 |

$551.96 |

$542.47 |

|

|

Canadian Pacific |

CP |

2.31 |

2.38 |

$1,670.00 |

$1,689.37 |

|

|

Coca-Cola** |

KO |

0.53 |

0.53 |

$11,976.00 |

$12,145.31 |

|

|

Harley-Davidson |

HOG |

0.69 |

0.60 |

$1,130.56 |

$1,144.50 |

|

|

Kimberly-Clark* |

KMB |

1.61 |

1.54 |

$5,442.00 |

$5,352.63 |

|

|

Lockheed Martin |

LMT |

2.76 |

2.71 |

$11,114.00 |

$11,272.77 |

|

|

McDonald's** |

MCD |

1.51 |

1.37 |

$6,987.00 |

$7,191.89 |

|

|

Travelers** |

TRV |

2.61 |

2.28 |

$5,983.00 |

$5,931.34 |

|

|

United Technologies** |

UTX |

1.85 |

1.81 |

$16,168.00 |

$16,164.42 |

|

|

Verizon** |

VZ |

0.89 |

0.91 |

$31,586.00 |

$31,585.98 |

|

* = Open WSS Idea ** = Dow Component

Yesterday, the Dow climbed off the canvass despite IBM's big miss. On one hand, it wasn't a real "surprise" and one wonders what the analysts covering these names are thinking with models that aren't catching what non-analysts could tell them from anecdotal observation.| Tweet |

Log In To Add Your Comment

| 4/24/2024 7:26 AM | BUYING THE DIP |

| 4/23/2024 1:25 PM | Bloom Off Rose |

| 4/23/2024 9:32 AM | WHAT HAPPENED TO THE BRAVADO? † |

| 4/22/2024 1:22 PM | Pins and Needles |

| 4/22/2024 9:30 AM | LIVE BY THE SWORD Ö |

| 4/19/2024 1:20 PM | Fair Chunk of Rotation |

| 4/19/2024 9:35 AM | DONíT OVERREACT † |

| 4/18/2024 1:37 PM | Didnít Break Down |

| 4/18/2024 9:40 AM | MARKET OFF SCRIPT † |

| 4/17/2024 1:59 PM | Facing Pressure |

| 4/17/2024 9:37 AM | POWELL STILL WANTS TO HELP † |

| 4/16/2024 1:35 PM | Muted |

| 4/16/2024 9:42 AM | FEAR ARRIVES † |

| 4/15/2024 1:17 PM | Making a Statement |

| 4/15/2024 9:45 AM | Equal Opportunity Drubbing |

| 4/12/2024 1:37 PM | Pressure Overall |

| 4/12/2024 9:42 AM | WHO YA GONNA CALL? |

| 4/11/2024 1:38 PM | No Urgency |

| 4/11/2024 9:27 AM | Tough Sledding |

| 4/10/2024 1:22 PM | Hang In There |

| 4/10/2024 9:51 AM | HERE COMES THE LATEST RATIONALE FOR PERSISTENT INFLATION |

| 4/9/2024 1:56 PM | Fighting the Trend |

| 4/9/2024 9:46 AM | NEXT TIME, MAKE IT A HOLIDAY |

| 4/8/2024 9:45 PM | Cautious Feel |

| 4/8/2024 7:19 AM | ITíS ECLIPSE DAY |

| More commentary archives | |

|

Home |

Products & Services |

Education |

In The Media |

Help |

About Us |

Disclaimer | Privacy Policy | Terms of Use | All Rights Reserved.

|