Morning Commentary

Morning Commentary

By Charles Payne, CEO & Principal Analyst

10/17/2014 7:48 AM

What's the greatest threat to the market and the economy?

- Change in Fed policy

- Deflation/slowing global economy

- Overleveraged (see chart)

- ISIS/Terrorism

- Ebola

- Crisis of Confidence

- Slowing US economy

For all the scuttlebutt about the Fed initiating another round of extraordinary accommodation, the only change is that the first interest rate-hike will move to December of next year from September 2015. In fact, some members would like to see action sooner rather than later. Moreover, it was leaked earlier this week that Janet Yellen sees the economy improving nicely. Yesterday, Charles Plosser, head of the Philadelphia Fed, echoed that same notion with several comments about the economy moving "more quickly than anticipated.”

On the other hand, James Bullard, President of the St Louis Fed, said he would like to see the Federal Open Market Committee (FOMC) hold off on the last bit of quantitative easing (QE) until December and hike rates in the first quarter of 2015. It seems like an odd statement, since it is a five-month window at most to finish with QE accommodation and then hike rates- Wall Street could not handle such a scenario.

Moreover, it seems ludicrous in so many ways to suggest the Fed buy $15 billion of agency mortgage-backed securities and treasuries bonds, it would be enough to manipulate the stock market higher. Fed action is designed to discourage savings and make equities more attractive, but the math seems dubious.

- October 15 NASDAQ- $119.4 billion in volume

- September 30 NYSE- $ 48.2 billion in volume

The reality is $150 billion or so in trading activity on a daily basis (or $3.0 trillion a month) and $15.0 billion of buying in bonds will make or break the outcome. I know a lot of smart people that trade on Fed news, however, as an investor, you need to know the fundamentals before following the crowd (on that nonsense), if you’re thinking about retiring with greater wealth. As for the economy, none of the Fed money printing has circulated in the economy. I am sure you already know this, but here is further confirmation via the St. Louis Fed in the chart below.

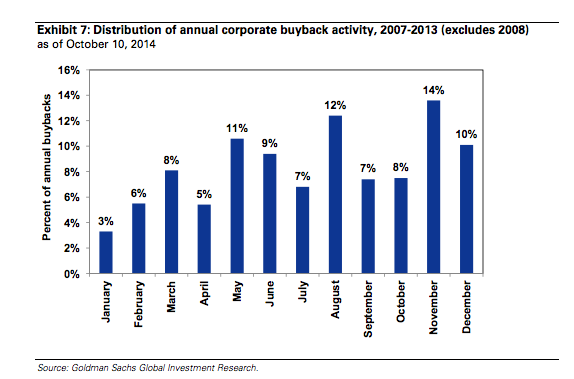

Corporations have benefited from lower rates with huge stock buybacks. Purists argue that it is financial engineering, but others say it is a legit way to reward shareholders. I agree with the latter. It has been amazing, however, how well this works out. Consider Las Vegas Sands: big miss on the top and bottom, but announcing $2 billion in buyback, and upping its dividend by 45% made the stock one of the big winners in yesterday’s session.

The good news for investors is that November is the biggest month of the year for corporate buybacks, and December is not too bad, either.

I still think US global economic slowdown is the biggest threat to our economy and stock market… especially, if we continue down this path. Remember that in November.

Today’s Session

The Bureau of Labor Statistics released the September Housing Starts and Permits Report this morning which had quite an impact on the market. For the month, housing starts came in better than expected at 1.017 million units compared to the consensus estimate of 1.010 million units. The August housing starts were revised slightly higher to 957,000 units from 956,000 units. September housing permits were not as impressive in the sense that they came in lower than anticipated at 1.018 million versus the expected 1.027 million units. However, August housing permits were also revised higher to 1.003 million units from 998,000 units. With this data, we can conclude that housing data remains volatile. Paired with yesterday’s National Association of Home Builders (NAHB) housing market index, lower permits in September reiterate the notion that there continues to be a decrease in interest for new homes, despite the low mortgage rates.

Market futures got a lift from corporate earnings this morning. A lot of companies were able to deliver on both top and bottom line this morning.

|

Company |

Ticker |

EPS (Actual) |

EPS (Est) |

Rev (Actual $M) |

Rev (Est $M) |

|

Advanced Micro |

AMD |

0.03 |

0.04 |

$1,429.00 |

$1,472.88 |

|

AthenaHealth* |

ATHN |

0.27 |

0.27 |

$190.43 |

$190.68 |

|

Capital One* |

COF |

1.86 |

1.95 |

$5,639.00 |

$5,570.01 |

|

Google* |

GOOG |

6.35 |

6.53 |

$16,523.00 |

$16,586.52 |

|

Schlumberger* |

SLB |

1.49 |

1.46 |

$12,600.00 |

$12,634.16 |

|

Stryker |

SYK |

1.15 |

1.14 |

$2,389.00 |

$2,319.50 |

|

BNY Mellon |

BK |

0.82 |

0.61 |

$3,752.00 |

$3,911.96 |

|

General Electric** |

GE |

0.38 |

0.37 |

$36,174.00 |

$36,766.59 |

|

Honeywell |

HON |

1.47 |

1.41 |

$10,108.00 |

$10,038.68 |

|

Kansas City Southern |

KSU |

1.29 |

1.26 |

$677.50 |

$672.54 |

|

Morgan Stanley |

MS |

0.65 |

0.53 |

$8,907.00 |

$8,176.47 |

|

Textron |

TXT |

0.60 |

0.53 |

$3,430.00 |

$3,604.81 |

** = Dow Component * = Open WSS Idea

| Tweet |

Log In To Add Your Comment

| 4/24/2024 1:30 PM | Earnings Flood In |

| 4/24/2024 9:26 AM | BUYING THE DIP |

| 4/23/2024 1:25 PM | Bloom Off Rose |

| 4/23/2024 9:32 AM | WHAT HAPPENED TO THE BRAVADO? |

| 4/22/2024 1:22 PM | Pins and Needles |

| 4/22/2024 9:30 AM | LIVE BY THE SWORD … |

| 4/19/2024 1:20 PM | Fair Chunk of Rotation |

| 4/19/2024 9:35 AM | DON’T OVERREACT |

| 4/18/2024 1:37 PM | Didn’t Break Down |

| 4/18/2024 9:40 AM | MARKET OFF SCRIPT |

| 4/17/2024 1:59 PM | Facing Pressure |

| 4/17/2024 9:37 AM | POWELL STILL WANTS TO HELP |

| 4/16/2024 1:35 PM | Muted |

| 4/16/2024 9:42 AM | FEAR ARRIVES |

| 4/15/2024 1:17 PM | Making a Statement |

| 4/15/2024 9:45 AM | Equal Opportunity Drubbing |

| 4/12/2024 1:37 PM | Pressure Overall |

| 4/12/2024 9:42 AM | WHO YA GONNA CALL? |

| 4/11/2024 1:38 PM | No Urgency |

| 4/11/2024 9:27 AM | Tough Sledding |

| 4/10/2024 1:22 PM | Hang In There |

| 4/10/2024 9:51 AM | HERE COMES THE LATEST RATIONALE FOR PERSISTENT INFLATION |

| 4/9/2024 1:56 PM | Fighting the Trend |

| 4/9/2024 9:46 AM | NEXT TIME, MAKE IT A HOLIDAY |

| 4/8/2024 9:45 PM | Cautious Feel |

| More commentary archives | |

|

Home |

Products & Services |

Education |

In The Media |

Help |

About Us |

Disclaimer | Privacy Policy | Terms of Use | All Rights Reserved.

|