All Eyes on Us: Top Cybersecurity Stocks to Invest in 2015

2/26/2015

By Charles Payne

It’s early, but no matter what happens around the world, or in the stock market, I’m confident in saying that 2015 will go down as the year of Cybercrime. And, that’s major, considering the massive attacks last year that hit companies, such as Target and JP Morgan.

Already 2015 has seen two major cyber attacks. The Cybernak gang stole $1 billion from 100 banks and hackers acquired the personal data of millions of Anthem clients.

Cyber security stocks will be one of the hottest investment opportunities in technology for 2015. With each attack, the potential for these stocks skyrockets.

Download the free report which features 5 stocks in this super hot industry.

Click here to register and download your free report.

If you are already a subscriber, please download the report here.

Is it too late to buy supercharged cyber stocks? A tantalizing combination of momentum and growth, cybersecurity is one of the hottest opportunities in the market.

If you are not already sitting on a nice profit from our special Cybersecurity Report, finding an entry point is actually easier than you might think. Read on for an important update on the cybersecurity industry and one of our recommendations

Special Reports

Take a free trial to access Charles' best picks and advice. This is the best way to evaluate the service in real-time and make an informed decision.

CLICK HERE TO GET STARTED |

June 10, 2015

In February, we issued a report on cybersecurity and featured 5 stock recommendations. ALL FIVE ARE BIG WINNERS! 100% home runs. We really hope you acted on these recommendations and are sitting on a healthy profit right now. If not, don't worry, there is good news!

You may be wondering what comes next? As cyber terrorism continues to be a major threat to government agencies and private businesses, cybersecurity stocks are the big winners. Just last week, the Department of Homeland Security detailed another hack to U.S. government computer networks. Nearly every government agency was hacked, leaving the personal data of four million current and former federal employees vulnerable. This hack, suspected to be the work of the Chinese state is the largest breach of federal employee data and is the second attack on the agency in less than a year.

Over the past few quarters, the demand for cybersecurity has risen. According to Gartner, an information technology research and advisory company, cybersecurity providers are seeing double-digit top-line growth while overall IT spending is anticipated to grow just under 3% in 2015.

As the landscape for cyber threats grows increasingly complex, many IT security teams are grappling with ways to keep pace with plethora of advanced threats and the volume of alerts. The stakes are high, and with attacks becoming more prevalent, the need for sophisticated security measures is even more crucial.

Check out this powerhouse company

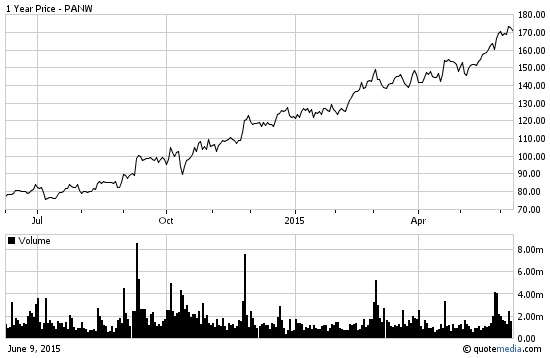

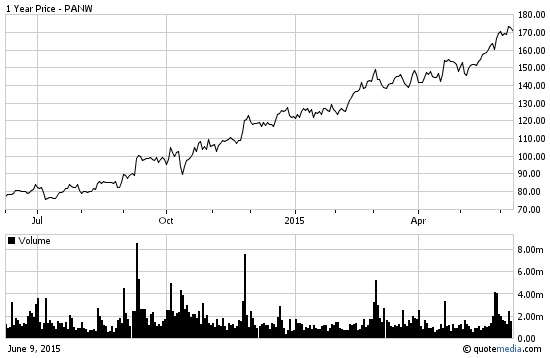

One of the stocks in our Free Cybersecurity Report is Palo Alto Networks (PANW), which is up big time, over $30+ since we featured it in your free copy and we see even more potential! Subscribers of our premium Hotline service received an updated recommendation on this hot stock last week.

Palo Alto Networks, a leader in enterprise security, was founded in 2005 in Santa Clara, California and provides an enterprise security platform to businesses, service providers, and government entities worldwide. On June 8, the company announced enhancements to its security platform included in its PAN-OS 7.0 release, which expands its prevention capabilities through enhanced analysis, automation and operational efficiencies and is designed to assist in blocking threats. New features help security professionals overcome the massive volume of alerts and manual processes and expand prevention capabilities while boosting boost operational efficiency.

"As organizations grow and adopt new technologies like virtualized datacenters amidst an evolving and complex threat landscape, security teams are implementing more security devices and policies. Streamlined management capabilities like those introduced in Palo Alto Networks PAN-OS 7.0 can extend prevention capabilities and dramatically reduce the likelihood of human error that often causes a significant amount of network downtime." - Jeff Wilson, research director, cybersecurity technology, Infonetics.

Shares of PANW have been making a strong, steady climb to the upside and we believe that there is even greater upside to come. EPS estimates have been consistently revised higher across the board over the last three months. In addition, PANW beat expectations in all of the last four quarters and is forecasted to grow net sales by 50.4% in FY15 over the prior year. PANW is expected to expand its business at a compounded annual growth rate (CAGR) of 49.4% over the next five years. Based off the rate of topline growth, it appears that Palo Alto Networks is stealing market share in its industry. The company nearly doubled its investment in Research and Development and is seeing significant growth in its product and services demand overseas. We see shares moving to $200.

Have more questions?

We are here to help and want you to have success with investing. I hope you will accept this invitation to try our premium services. Feel free to email research@wstreet.com with any questions you may have.

|

Charles Payne

Wall Street Strategies

Add a Comment!

|